OBBBA Brings 45X Changes, Though Not Wholesale Repeal

Tax Alert

Congress enacted the section 45X advanced manufacturing production tax credit as part of the Inflation Reduction Act (IRA) in 2022. Essentially, taxpayers that domestically produce and sell "eligible components" to unrelated persons – typically the building blocks of green energy supply like electric vehicle batteries and cells as well as wind and solar components – receive a tax credit, which varies depending on the eligible component. (See previous coverage here.)

Section 45X had been in the crosshairs of some congressional Republicans well before President Trump's reelection. However, the provision was largely spared from overhaul by the One Big Beautiful Bill Act (OBBBA) signed into law on July 4, 2025. Instead, the OBBBA largely preserved the section 45X credit, while adding certain guardrails.

No Accelerated Phase Out for Most Eligible Components, Expansion to Metallurgical Coal

Most significantly, the OBBBA did not accelerate the phase-out of the section 45X credit. This is in contrast to other green energy credits, like those for purchasing or leasing electric vehicles (sections 30D and 45W) and the investment and production tax credits for clean energy facilities (section 45Y and 48E). It was also a change from earlier drafts of the legislation, including the one first passed by the House on May 29, 2025. Under the OBBBA, as under the IRA, phase out generally begins in 2030. The one exception is wind energy eligible components, which are now unavailable for sales after 2027.

The OBBBA also added a production tax credit for metallurgical coal – defined as coal that is suitable for use in the production of steel (regardless of the location of that production) – of 2.5 percent of the costs incurred with respect to such production. This eligible component is not subject to phase out; the credit is unavailable beginning in 2030.

Material Assistance from Specified Foreign Entities

Perhaps most significantly, the OBBBA amended section 45X(c)(1)(A)(ii)(C) to provide that in the case of tax years beginning after July 4, 2025, the term "eligible component" does not include any property produced with "material assistance from any prohibited foreign entities." Such entities are likewise themselves ineligible to claim the credit.

Prohibited foreign entities (PFEs) include specified foreign entities (SFEs). Expanding on the concept of "foreign entities of concern" from the IRA, section 7701(a)(51) now broadly defines SFEs as including any entities organized under the laws of China, North Korea, Iran, or Russia, or controlled by an entity organized under the laws of one of those countries. Also included are so-called "foreign influenced entities" (FIEs), which are entities over which an SFE has a certain level of control, either through governance rights (i.e., the ability to appoint a director) or through contractual rights that allow the "effective control" of the production of an eligible component.

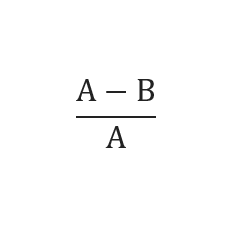

Whether a PFE has provided "material assistance" with respect to the production of an eligible component is determined by reference to a "material assistance cost ratio." Section 7701(a)(52)(D)(ii) defines the material assistance cost ratio as follows:

- A = the total direct material costs that are paid or incurred (within the meaning of section 461 and any regulations issued under section 263A) by the taxpayer for production of such eligible component

- B = the total direct material costs that are paid or incurred (within the meaning of section 461 and any regulations issued under section 263A) by the taxpayer for production of such eligible component that are mined, produced, or manufactured by a prohibited foreign entity

The statutory language of "B" is not clear, as the phrase "costs… that are mined, produced or manufactured by a" PFE does not make grammatical sense. We expect administrative guidance, and possibly even a legislative technical correction, to address this issue. The intended language was possibly "the total direct material costs that are paid or incurred by the taxpayer for the production of such eligible component that are attributable to constituent elements, materials, or subcomponents of that eligible component mined, produced, or manufactured by a prohibited foreign entity." The "constituent element, material, or subcomponent" language is found in the applicable safe harbor rule discussed below, so while it is reasonable to think Congress meant to include it here, it is not clear.

The permissible material assistance cost ratio – which can be thought of as the percentage of the taxpayer's direct material costs for a given eligible component allocable to non-PFE sources – varies depending on the eligible component, and increases with time. For example, in the case of qualifying battery components, the required ratio is 60 percent for calendar year 2026, increasing to 85 percent by calendar year 2030.

The statute explicitly directs the Department of the Treasury and the Internal Revenue Service (IRS) to issue "safe harbor tables" to identify the percentage of total direct materials costs of any eligible component attributable to a PFE by the end of 2026, and provides that the tables included in IRS Notice 2025-08 may be used until such guidance is released. However, that notice does not address eligible components, but qualified facilities for purposes of the section 45Y PTC and section 48 ITC in the context of the domestic content bonus. It is not clear how it will apply as a safe harbor for eligible components, and additional guidance is needed.

There are many other complexities of the material assistance cost ratio calculation that are beyond the scope of this news item. Suffice it to say, practitioners are already questioning how taxpayers are to apply this provision in practice and eagerly anticipate guidance.

Other Changes

The OBBBA made some other changes to section 45X. One is an enhanced "integrated component rule." For tax years that begin after December 31, 2026, at least 65 percent of the direct material cost of an integrated component must come from primary components manufactured in the U.S. In addition, new statutory language clarified the definition of battery module (an eligible component), requiring it to be "comprised of all…essential equipment needed for battery functionality, such as current collector assemblies and voltage sense harnesses, or any other essential energy collection equipment."

For more information, please contact:

Andy L. Howlett, ahowlett@milchev.com, 202-626-5821

Katherine Lewis, klewis@milchev.com, 202-626-5894

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.